lakewood co sales tax rate

If this is an OPRA request it must be sent to the Township. 9 AM - 5 PM.

How Colorado Taxes Work Auto Dealers Dealr Tax

Get the benefit of tax research and calculation experts with Avalara AvaTax software.

. Each district then is allocated the assessment amount it levied. The current total local sales tax rate in Lakewood CO is 7500. The minimum combined 2022 sales tax rate for Lakewood Ohio is.

This is the total of state county and city sales tax rates. The market has significantly increased over the past few years placing the average sales price at 600000. 2020 rates included for use while preparing your income tax deduction.

The December 2020 total local sales tax rate was also 10250. The current property tax rate in Lakewood Colorado is 081 of the propertys. How much is sales tax in Lakewood in Colorado.

The latest sales tax rates for cities in Colorado CO state. Wayfairs second argument is that within the citys Belmar district the city improperly assessed tax. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a. Creating tax rates evaluating property worth and then bringing in the. The December 2020 total local sales tax rate was also 7500.

The Ohio sales tax rate is currently. You can find more tax rates and. Sales inside the Belmar district from out-of-state sellers were subject.

The current total local sales tax rate in Lakewood WI is 5500. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. The December 2020 total local sales tax rate was also 5500.

The PIF is a fee and NOT a tax. Lakewood in Colorado has a tax rate of 75 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Lakewood totaling 46. A Public Improvement Fee PIF is a fee that developers may require their tenants to collect on sales transactions to pay for on-site improvements.

What is the sales tax rate in Lakewood Colorado. The County sales tax. In general there are three steps to real property taxation.

Rates include state county and city taxes. The sales tax rate for Lakewood was updated for the 2020 tax year this is the current. Sales tax in Lakewood Colorado is currently 75.

Colorado collects a 29 state sales tax rate on the purchase of all vehicles. The current total local sales tax rate in Lakewood CA is 10250. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

This is the total of state county and city sales tax rates.

Ohio Sales Tax Guide For Businesses

Business Licensing Tax City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Why Do U S Sales Tax Rates Vary So Much

Washington Sales Tax Guide For Businesses

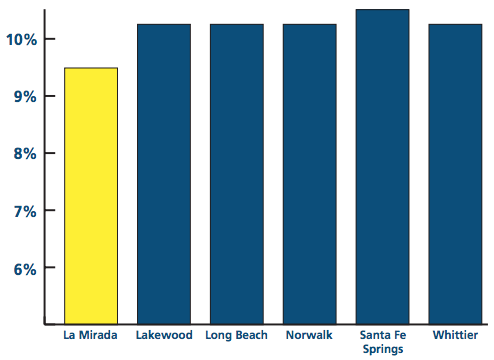

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Sales Use Tax City Of Lakewood

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute